선요약 : 제이피모건 JPMorgan은 2021년에 매수해야 할 50개의 '가장 설득력 있는' 주식을 공개했다.

JPMorgan은 투자자들이 2021년에 최고의 수익을 얻기 위해 주식에 대한 성장 지향적 접근법과 가치 지향적 접근법을 혼합해야 한다고 경고한다.

JPMorgan은 투자자들에게 정반대의 두 가지 접근법으로 큰 수익을 올릴 수 있다고 말할 정도로 2021년 주식에 대해 긍정적인 전망을 보인다.

두브라브코 라코스-부하스 미국 주식전략가는 S&P 500이 내년 초에 4,000까지 갈것이라고 한다.

그리고 연말까지 4,500선까지 오를 수 있을 것이라고 한다.

JPMorgan의 48대 성장 및 가치선정 종목은 애널리스트들의 2021년 말 가격목표를 바탕으로 그들이 얼마나 많은 상승세를 제공하는지 오름차순으로 정리되어 있다.

모든 종목은 JPMorgan 애널리스트들의 '비중확대' 등급을 갖고 있다.

50. Discover Financial

Ticker: DFS

Sector: Financials

Strategy: Value

Case: "We believe the primary catalyst for shares in 2021 will be increased visibility to long-term capital returns." — Richard Shane

Price target: $72

Upside to target: -14.4%

Source: JPMorgan Chase

49. Cimarex

Ticker: XEC

Sector: Energy

Strategy: Value

Case: "XEC is one of our top picks as we expect all three commodities to be working for the company in a positive direction." — Arjun Jayaram

Price target: $35

Upside to target: -11.1%

Source: JPMorgan Chase

48. TG Therapeutics

Ticker: TGTX

Sector: Healthcare

Strategy: Growth

Case: "We view the coming year as value defining for TGTX's heme-oncology franchise along with, assuming phase 3 ULTIMATE's success, compelling optionality held by ublituximab in an expanding anti-CD20 RMS market, and see shares continuing to outperform both our broader coverage universe, and the sector as whole." — Eric Joseph

Price target: $38

Upside to target: -8.9%

Source: JPMorgan Chase

47. Spirit AeroSystems

Ticker: SPR

Sector: Industrials

Strategy: Value

Case: "We see the ramp on 737 profits giving Spirit appealing exposure to a multi-year Aero recovery. We view Boeing's future as very much dependent on ramping MAX production in the coming years, and this gives Boeing a strong incentive to sell the key platform that drives Spirit's profitability." — Seth Seifman

Price target: $36

Upside to target: -7.0%

Source: JPMorgan Chase

46. Wynn Resorts

Ticker: WYNN

Sector: Consumer discretionary

Strategy: Growth

Case: "Likely sequential improvements in Macau (and, honestly, not much has to happen for this to occur) will continue to drive WYNN higher." — Joseph Greff

Price target: $106

Upside to target: -6.1%

Source: JPMorgan Chase

45. Honeywell

Ticker: HON

Sector: Industrials

Strategy: Growth

Case: "We view HON as a best-in-class diversified growth story, positioned well on several fronts such as warehouse automation (e-commerce) and building efficiency (IAQ/ESG thematic)." — C. Stephen Tusa

Price target: $200

Upside to target: -5.6%

Source: JPMorgan Chase

44. Bank of America

Ticker: BAC

Sector: Financials

Strategy: Value

Case: "Bank of America is one of our more rate sensitive names and should benefit from rise in long term rates. Bank of America has strong capital levels and should also benefit from further capital return. Finally, BofA has a more conservative credit risk profile, which should better position it if economic recovery is weaker than expected." — Vivek Juneja

Price target: $27.50

Upside to target: -5.5%

Source: JPMorgan Chase

43. Arista Networks

Ticker: ANET

Sector: Growth

Strategy: Information technology

Case: "We expect Arista to return to double-digit revenue growth in FY21 ... helped by rebound in US cloud provider spending (forecast >20% capex growth vs. 8% in FY20) and recovery in Enterprise spending" — Samik Chatterjee

Price target: $275

Upside to target: -0.5%

Source: JPMorgan Chase

42. Wyndham Hotels & Resorts

Ticker: WH

Sector: Consumer discretionary

Strategy: Value

Case: "We remain confident that WH can generate above peer operating results in the near/medium term given its focus on franchising, leisure and drive to business with mostly non-urban economy/mid-scale select service hotels, and thus can continue to close the valuation gap to peers" — Joseph Greff

Price target: $59

Upside to target: 0.3%

Source: JPMorgan Chase

41. Ascendis Pharma

Ticker: ASND

Sector: Healthcare

Strategy: Growth

Case: "Following a string of positive catalysts, each of which were de-risking for the pipeline ... we see ASND delivering on the promise of its platform." — Jessica Fye

Price target: $177

Upside to target: 0.4%

Source: JPMorgan Chase

40. KLA

Markets Insider

Ticker: KLAC

Sector: Information technology

Strategy: Value

Case: "KLAC is our top pick in semi-caps on diversified growth, strong product cycles, positive leverage to EUV, and growing shareholder returns." — Harlan Sur

Price target: $260

Upside to target: 1.6%

Source: JPMorgan Chase

39. Broadcom

Ticker: AVGO

Sector: Information technology

Strategy: Value

Case: "Even in a tougher environment, we continue to expect an increase to annual dividends in December (from $13.00 today) and 8-12% annual dividend growth beyond this year." — Harlan Sur

Price target: $420

Upside to target: 2.4%

Source: JPMorgan Chase

38. Phillips 66

Ticker: PSX

Sector: Energy

Strategy: Value

Case: "While PSX has been less defensive than we hoped in 2020, owing to weaker-than-expected performance in the Refining segment, we still think that earnings should hold up better than for most companies in Energy, aided by its portfolio diversity." — Phil Gresh

Price target: $73

Upside to target: 3.0%

Source: JPMorgan Chase

37. Disney

Ticker: DIS

Sector: Consumer discretionary

Strategy: Growth

Case: "Disney will benefit from greater reopening of Parks and resumption of theatrical releases while driving further growth at its streaming services. We believe investors should continue to appreciate the exceptional growth in digital subs and Disney's superior content as the sub growth story continues in F21" — Alexia Quadrani

Price target: $160

Upside to target: 3.4%

Source: JPMorgan Chase

36. Caterpillar

Ticker: CAT

Sector: Industrials

Strategy: Value

Case: "We believe CAT's earning power and FCF conversion over this upcoming cycle, supported by a new US construction cycle, continue to merit our Overweight rating. ... we view CAT as the biggest winner of a potential federal infrastructure bill." — Ann Duignan

Price target: $185

Upside to target: 3.4%

Source: JPMorgan Chase

35. Coca-Cola

Ticker: KO

Sector: Consumer staples

Strategy: Near term

Case: "We believe KO still offers investors a unique combination of top-line growth and gross margin expansion." — Andrea Teixeira

Price target: $55

Upside to target: 3.7%

Source: JPMorgan Chase

34. Globe Life

Ticker: GL

Sector: Financials

Strategy: Growth

Case: "GL is the strongest franchise in the life sector, in the long run, and one of the best positioned firms in the current environment due to its superior ROE, strong free cash flow, and below-average EPS sensitivity to interest rates or the equity market." — Jimmy Bhullar

Price target: $99

Upside to target: 4.3%

Source: JPMorgan Chase

33. Fiserv

Ticker: FISV

Sector: Information technology

Strategy: Near term

Case: "While the tech is relatively dated, we believe management will develop a plan to modernize without disrupting its large scale and distribution footprint that have allowed the company to grow at a premium to direct peers in the most recent quarter." — Tien-tsin Huang

Price target: $120

Upside to target: 4.5%

Source: JPMorgan Chase

32. Microsoft

Ticker: MSFT

Sector: Information technology

Strategy: Growth

Case: "Accelerated demand in some parts of its business stemming from work, learn and play-from home trends has only reinforced the narrative that Microsoft thrives at the intersection of digital transformation, cloud computing, and productivity." — Mark Murphy

Price target: $220

Upside to target: 4.5%

Source: JPMorgan Chase

31. Alphabet

Ticker: GOOGL

Sector: Communication services

Strategy: Value

Case: "Google Cloud profit disclosure will not only show the pace & magnitude of investments in Google Cloud, a key focus area, but also show how profitable the rest of Google Segment is, making SOTP more viable." — Harlan Sur

Price target: $1,870

Upside to target: 5.8%

Source: JPMorgan Chase

30. Robert Half International

Markets Insider

Ticker: RHI

Sector: Industrials

Strategy: Growth

Case: "RHI is both a dominant and an innovative leader in professional staffing with expertise in accounting and finance (F&A). In past economic cycles, RHI has seen double-digit growth in its perm and temp help business in the first few years coming out of the recession, and we believe this cycle should be no different." — Andrew Steinerman

Price target: $68

Upside to target: 6.0%

Source: JPMorgan Chase

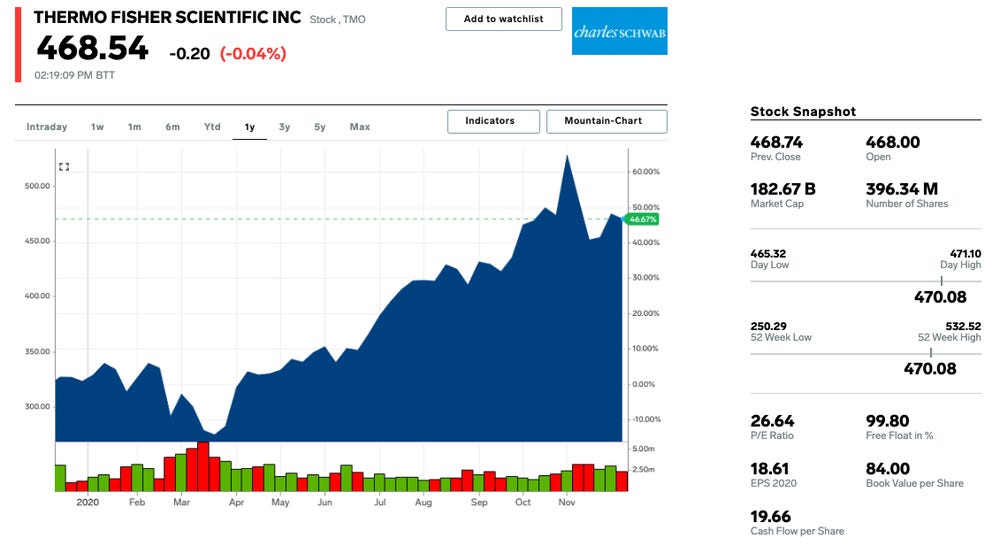

29. Thermo Fisher Scientific

Markets Insider

Ticker: TMO

Sector: Healthcare

Strategy: Growth

Case: "We see both durability and further upside in COVID tailwinds ... Longer term, TMO's growing biopharma exposure and leading product innovation should fuel persistent above-market growth." — Tycho Peterson

Price target: $500

Upside to target: 6.7%

Source: JPMorgan Chase

28. Norfolk Southern

Ticker: NSC

Sector: Industrials

Strategy: Growth

Case: "Norfolk represents the best in class opportunity to improve the worst in class operating ratio after lagging peers in volume growth." — Brian Ossenbeck

Price target: $253

Upside to target: 7.0%

Source: JPMorgan Chase

27. Bloomin' Brands

Ticker: BLMN

Sector: Consumer discretionary

Strategy: Value

Case: "Bloomin' Brands' shored-up balance sheet, largely mid-scale exposed US business, recovering Brazil and company-specific margin improvement efforts screen attractive among casual diners." — John Ivankoe

Price target: $20

Upside to target: 9.7%

Source: JPMorgan Chase

26. Aon

Ticker: AON

Sector: Financials

Strategy: Growth

Case: "We view brokerage as the most attractive business segment within P&C insurance from a long-term structural standpoint. Additionally, we believe that brokers are defensively positioned in the current economic backdrop. Among large brokers, AON is our favorite stock." — Jimmy Bhullar

Price target: $228

Upside to target: 10.6%

Source: JPMorgan Chase

25. AbbVie

Ticker: ABBV

Sector: Healthcare

Strategy: Value

Case: "ABBV remains one of our favorite names in the group as we see ongoing upside from Skyrizi and Rinvoq (where we highlight a number of line extension catalysts over the next 12 months) as well as an improving mid/late-stage pipeline." — Chris Schott

Price target: $120

Upside to target: 11.6%

Source: JPMorgan Chase

24. First Republic Bank

Ticker: FRC

Sector: Financials

Strategy: Growth

Case: First Republic's pre-tax pre-provision profit "income growth potential is likely to widen further above peers.'" —Alex Lau

Price target: $148

Upside to target: 13.6%

Source: JPMorgan Chase

23. Humana

Ticker: HUM

Sector: Healthcare

Strategy: Growth

Case: "Humana is largely a pure play story for the Medicare Advantage (MA) market. MA is the fastest-growing line of health insurance ... HUM already provided the most robust 2021 outlook in the sector, which is attractive in a year characterized by increased margin uncertainty for health insurers." — Gary Taylor

Price target: $452

Upside to target: 13.7%

Source: JPMorgan Chase

22. Targa Resources

Markets Insider

Ticker: TRGP

Sector: Energy

Strategy: Growth

Case: "TRGP possesses full value chain integration and best in class Permian leverage. Importantly, having right sized the dividend and largely completed its project backlog, Targa possesses visibility to deleveraging and share repurchases." — Jeremy Tonet

Price target: $32

Upside to target: 14.0%

Source: JPMorgan Chase

21. General Motors

Ticker: GM

Sector: Consumer discretionary

Strategy: Value

Case: "Greater than presumed resiliency, combined with accelerating investments in electric vehicles to rival much more highly valued peers, we think could engender multiple expansion in 2021 even as earnings surge back as volume rebounds." — Ryan Brinkman

Price target: $49

Upside to target: 14.3%

Source: JPMorgan Chase

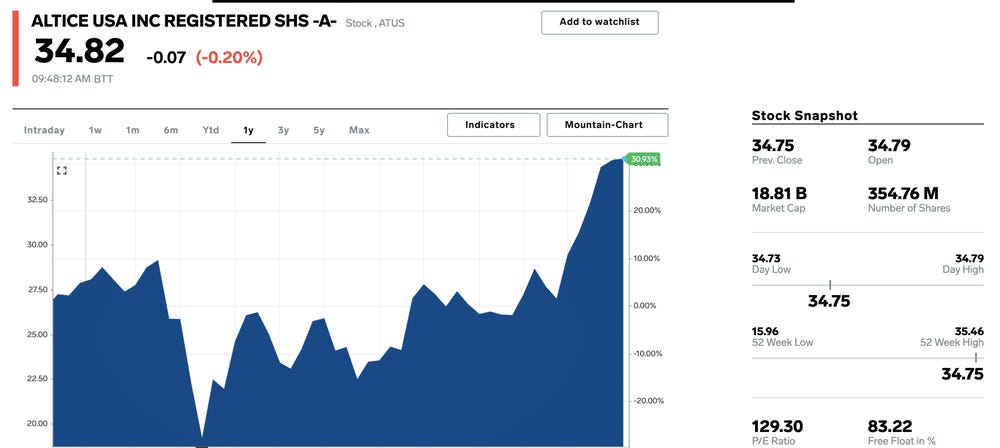

20. Altice USA

Ticker: ATUS

Sector: Communication services

Strategy: Value

Case: "We continue to like Altice based on solid fundamentals, strong capital returns, and 11.5% fully-taxed 2022 FCF yield." — Philip Cusick

Price target: $40

Upside to target: 15.1%

Source: JPMorgan Chase

19. Mondelez International

Ticker: MDLZ

Sector: Consumer staples

Strategy: Growth

Case: "Many food-at-home companies will post deeply negative organic/same-store sales growth in 2021. To avoid stocks with these unfortunate optics, we lean toward companies that can still grow during 2021, such as Mondelēz." — Ken Goldman

Price target: $66

Upside to target: 15.4%

Source: JPMorgan Chase

18. Sarepta Therapeutics

Ticker: SRPT

Sector: Healthcare

Strategy: Growth

Case: "All told, recent volatility in SRPT shares amidst negative sentiment has shifted the reward / risk profile into the event to be more balanced / favorable." — Anupam Rama

Price target: $185

Upside to target: 15.6%

Source: JPMorgan Chase

17. Delta Air Lines

Ticker: DAL

Sector: Industrials

Strategy: Value

Case: "We continue to view Delta as the industry benchmark and a company that will likely benefit from the further rationalization of the global airline industry." — Jamie Baker

Price target: $50

Upside to target: 17.3%

Source: JPMorgan Chase

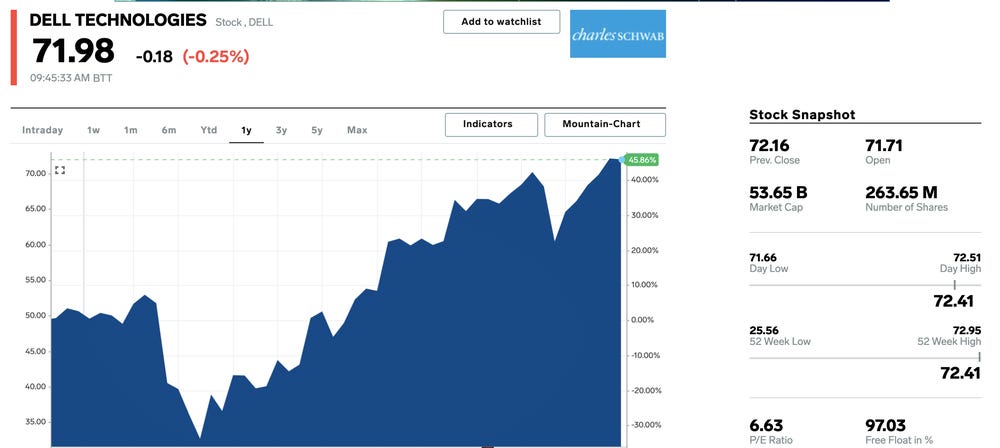

16. Dell Technologies

Ticker: DELL

Sector: Information technology

Strategy: Growth

Case: "Dell has executed well as work from home trends have benefited the consumer PC business ... Strong FCF in FY21 has enabled the firm to de-lever consistently throughout FY21." — Paul Coster

Price target: $85

Upside to target: 17.8%

Source: JPMorgan Chase

15. Baxter International

Ticker: BAX

Sector: Healthcare

Strategy: Value

Case: "We see significant long-term value in Baxter and view it as one of the top names in our large-cap coverage." — Robbie Marcus

Price target: $94

Upside to target: 18.7%

Source: JPMorgan Chase

14. Dominion Energy

Ticker: D

Sector: Utilities

Strategy: Growth

Case: "Dominion now represents a best-in-class, pure play regulated utility with attractive ESG growth plans." — Jeremy Tonet

Price target: $90

Upside to target: 21.1%

Source: JPMorgan Chase

13. Varonis Systems

Ticker: VRNS

Sector: Information technology

Strategy: Growth

Case: "Subscription transitions have been a consistent generator of outperformance in software over the last decade and VRNS appears to be following suit." — Sterling Auty

Price target: $160

Upside to target: 21.2%

Source: JPMorgan Chase

12. Ulta Beauty

Ticker: ULTA

Sector: Consumer discretionary

Strategy: Growth

Case: "We view ULTA as one of the best COVID-recovery stocks in retail as makeup consumption has lagged the broader market recovery ... we expect social-gathering starved consumers to engage highly in the make-up category as investors continue to look to 2022 earnings." — Christopher Horvers

Price target: $330

Upside to target: 21.3%

Source: JPMorgan Chase

11. Summit Materials

Ticker: SUM

Sector: Materials

Strategy: Value

Case: "SUM changed its CEO recently (a person coming from a different industry), and we expect to see a new phase for the company much more focused on integrating recent acquisitions." — Adrian Huerta

Price target: $24

Upside to target: 23.5%

Source: JPMorgan Chase

10. AmerisourceBergen

Ticker: ABC

Sector: Healthcare

Strategy: Value

Case: "The longer-term fundamental outlook for the pharmaceutical distribution industry is positive, driven by an aging population and increased utilization of prescription drugs. As ABC is essentially a pure-play in pharmaceutical distribution." — Lisa Gill

Price target: $123

Upside to target: 23.8%

Source: JPMorgan Chase

9. Brookfield Asset Management

Ticker: BAM

Sector: Financials

Strategy: Value

Case: "Brookfield Asset Management is a $578bn alternative asset manager with higher exposure to infrastructure/renewable than peers. BAM is entering an acceleration of its fundraising that will drive fee-earning AUM, revenue, and margins higher." — Kenneth Worthington

Price target: $53

Upside to target: 24.9%

Source: JPMorgan Chase

8. Americold Realty Trust

Ticker: COLD

Sector: Real estate

Strategy: Growth

Case: "We see COLD as an interesting way to play both defense and offense. COLD's business held up quite well during the Spring lockdowns due to the defensive nature of its business, and core growth potential continues to be above average." — Anthony Paolone

Price target: $43

Upside to target: 27.9%

Source: JPMorgan Chase

7. International Flavors & Fragrances

Ticker: IFF

Sector: Materials

Strategy: Value

Case: "We think that IFF shares may be pressured near term. ... Our December 2021 price target is $145 based on a 16.8x 2021 EV/EBITDA multiple (post the DNB transaction). Separately, IFF's business fundamentals are improving in North America." — Jeffrey Zekauskas

Price target: $145

Upside to target: 28.8%

Source: JPMorgan Chase

6. L Brands

Ticker: LB

Sector: Consumer discretionary

Strategy: Value

Case: "LB is on the path to establish Bath & Body Works as a standalone entity, with the concept offering high-single-digit same-store sales, sustainable low-20%+ operating margins, and low- to mid-single-digit annual square footage growth translating into a double-digit compounding bottom-line profile." — Matthew Ross

Price target: $53

Upside to target: 29.2%

Source: JPMorgan Chase

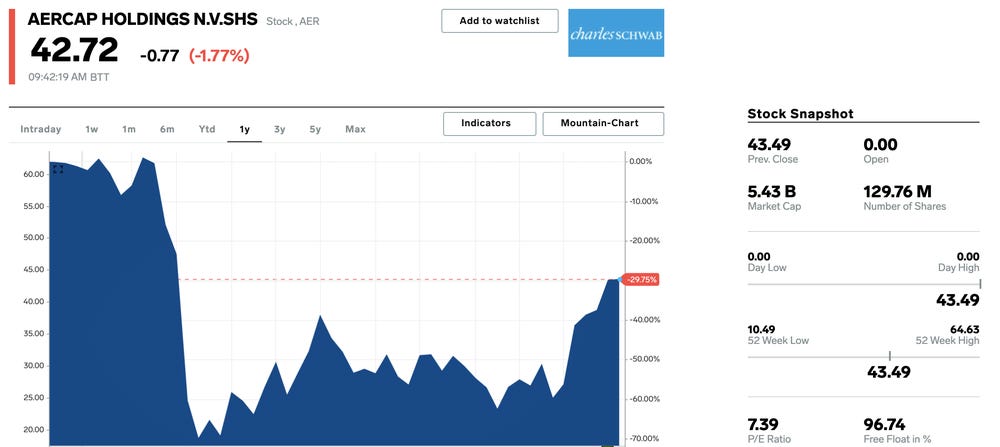

5. AerCap Holdings

Ticker: AER

Sector: Industrials

Strategy: Value

Case: "AerCap is our top pick for the Aircraft Leasing sector in 2021, as we believe the company affords investors compelling growth prospects through a healthy delivery backlog (only ~9% of fleet has leases expiring through 2022) and a well-diversified portfolio of aircraft." — Jamie Baker

Price target: $57

Upside to target: 31.1%

Source: JPMorgan Chase

4. Sunrun

Ticker: RUN

Sector: Industrials

Strategy: Growth

Case: "We look for RUN's profitability to accelerate in 2021 ... With Vivint Solar's largest holder completely finished selling its position in RUN, we believe an overhang on the stock is now removed, and we expect RUN to outperform the mean of our coverage" — Paul Coster

Price target: $79

Upside to target: 37.2%

Source: JPMorgan Chase

3. TechnipFMC

Ticker: FTI

Sector: Energy

Strategy: Value

Case: "FTI shares have been in a state of purgatory since the company put the brakes on a planned spin of Technip Energies in the spring. The stock is pricing in "worst-case" scenarios in our view, leaving lots of inexpensive optionality in both "old" and "new" energy channels." — Sean Meakim

Price target: $16

Upside to target: 59.5%

Source: JPMorgan Chase

2. PulteGroup

Ticker: PHM

Sector: Consumer discretionary

Strategy: Value

Case: "We continue to view the company's relative valuation as highly attractive when compared to its relative fundamental profile. Specifically, we estimate PHM will generate the highest gross margins across the larger-cap builders in 2021 and 2022." — Michael Rehault

Price target: $68

Upside to target: 61.3%

Source: JPMorgan Chase

1. BioMarin Pharmaceuticals 바이오마린 파마슈티컬스

Ticker: BMRN

Sector: Healthcare

Strategy: Growth

Case: "BioMarin remains our highest conviction idea heading into 2021 ... shares trade around the value of the base business. However, we suspect this could change with two potential value-inflecting clinical catalysts expected in January." — Cory Kasimov

Price target: $131

Upside to target: 68.5%

Source: JPMorgan Chase

#출처 : www.businessinsider.com/stock-picks-to-buy-2021-best-growth-value-investing-jpmorgan-2020-12#1-biomarin-pharmaceuticals-50

(자세한 내용은 자료 배포가 이뤄지는 본 출처 링크를 참고하시기 바랍니다.)

# 본 글은 주식 매수 매도 추천글이 아닙니다. 본 글에서 거론된 주식의 매수,매도는 투자자 본인의 판단이며 그 결과 또한 투자자 본인의 책임입니다.

'미국주식' 카테고리의 다른 글

| 2020년 워렌버핏의 최고 실적 5종목_미국주식x미국개미 (1) | 2020.12.14 |

|---|---|

| 로블록스(RBLX):2021년으로 연기된 상장일정 IPO_미국주식x미국개미 (1) | 2020.12.13 |

| 아사나(ASAN): 작업관리 플랫폼의 주가전망 & 정보_미국주식x미국개미 (3) | 2020.12.13 |

| 구글(GOOG,GOOGL)이 헬스케어의 다크호스가 될까?_미국주식x미국개미 (0) | 2020.12.12 |

| 우버(UBER): 각 주에 코로나바이러스 백신 우선 제공 요청_미국주식x미국개미 (3) | 2020.12.12 |