선요약 : JPMorgan의 글로벌 중소형주전략 책임자는 건강한 사업과 탄탄한 대차대조표를 가지고 있지만 주가가 저렴한 중소기업 그룹이 있다고 19개 종목을 추천했는데, 그냥 뭐가 있는지... 참고만 해야겠다...

Eduardo Lecubarri는 그 주식들이 강한 회복 잠재력을 가지고 있고 다음 해에 두드러질 수 있다고 말한다.

그는 많은 중소기업들의 수익이 내년에 2019년 수준으로 회복되지 않을 것이기 때문에 최근 주가 상승이 거의 남아 있지 않다고 말한다.

아무튼 이 기준에 부합하는 19개 미국 상장 종목을 JP모건의 가격 목표 대비 상승률을 기준으로 오름차순으로 순위를 매긴것이며, 아래와 같다.

19. Levi Strauss 리바이스

Ticker: LEVI

Sector: Consumer discretionary

Industry: Textiles, apparel, and luxury goods

Market cap: $4.8 billion

Upside to price target: 7%

18. ProPetro Holding 프로페트로홀딩

Ticker: PUMP

Sector: Energy

Industry: Energy equipment and services

Market cap: $580 million

Upside to price target: 12%

17. Magnolia Oil and Gas 매그놀리아오일앤가스

Ticker: MGY

Sector: Energy

Industry: Oil, gas, and consumable fuels

Market cap: $1.6 billion

Upside to price target: 17%

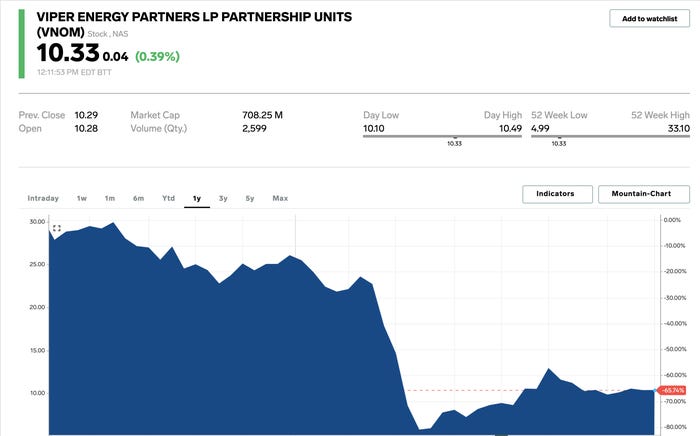

16. Viper Energy Partners

Ticker: VNOM

Sector: Energy

Industry: Oil, gas, and consumable fuels

Market cap:

Upside to price target: 26%

15. Cimarex

Ticker: XEC

Sector: Energy

Industry: Oil, gas, and consumable fuels

Market cap: $2.6 billion

Upside to price target: 31%

14. Parsley Energy

Ticker: PE

Sector: Energy

Industry: Oil, gas, and consumable fuels

Market cap: $4.2 billion

Upside to price target: 37%

13. Rattler Midstream

Ticker: RTLR

Sector: Energy

Industry: Oil, gas, and consumable fuels

Market cap: $353 million

Upside to price target: 40%

12. US Cellular

Ticker: USM

Sector: Communication services

Industry: Wireless telecommunication services

Market cap: $2.6 billion

Upside to price target: 42%

11. Adecoagro

Ticker: AGRO

Sector: Consumer staples

Industry: Food products

Market cap: $506 million

Upside to price target: 44%

10. Marathon Oil

Ticker: MRO

Sector: Energy

Industry: Oil, gas, and consumable fuels

Market cap: $4.6 billion

Upside to price target: 46%

9. Telephone and Data Systems

Ticker: TDS

Sector: Communication services

Industry: Wireless telecommunication services

Market cap: $2.3 billion

Upside to price target: 49%

8. Laureate Education

Ticker: LAUR

Sector: Consumer discretionary

Industry: Diversified consumer services

Market cap: $2.5 billion

Upside to price target: 50%

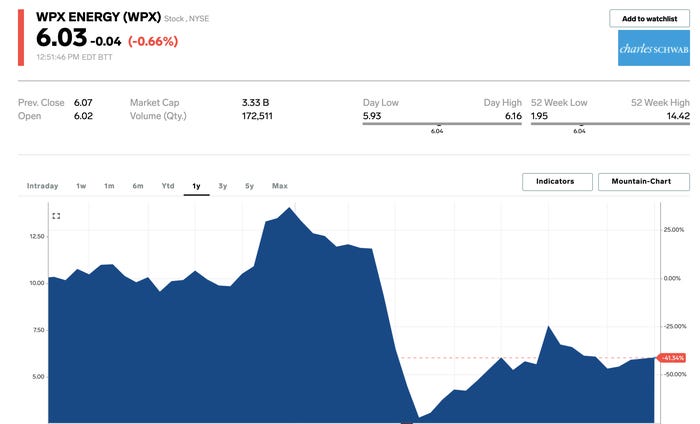

7. WPX Energy

Ticker: WPX

Sector: Energy

Industry: Oil, gas, and consumable fuels

Market cap: $3.3 billion

Upside to price target: 51%

6. Alaska Air Group 알래스카에어그룹

Ticker: ALK

Sector: Industrials

Industry: Airlines

Market cap: $4.3 billion

Upside to price target: 60%

5. Montage Resources 몬티지리소시스

Ticker: MR

Sector: Energy

Industry: Oil, gas, and consumable fuels

Market cap: $182 million

Upside to price target: 63%

4. National Energy Services Reunited 내셔널에너지서비스리유나이티드

Ticker: NESR

Sector: Energy

Industry: Energy equipment and services

Market cap: $635 million

Upside to price target: 64%

3. GrafTech International 그랩테크인터네셔널

Ticker: EAF

Sector: Industrials

Industry: Electrical equipment

Market cap: $1.7 billion

Upside to price target: 73%

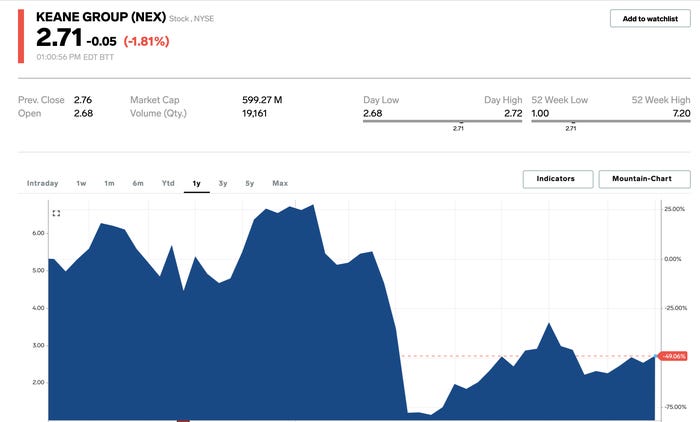

2. NexTier Oilfield Solutions 넥스티어오일필드솔루션즈

Ticker: NEX

Sector: Energy

Industry: Energy equipment and services

Market cap: $599 million

Upside to price target: 98%

1. Hollysys Automation Technology 홀리시스오토메이션테크놀로지

Ticker: HOLI

Sector: Information technology

Industry: Electronic equipment, instruments, and components

Market cap: $736 million

Upside to price target: 107%

#출처 : business insider , jpmorgan

# 본 글은 주식 매수 매도 추천글이 아닙니다. 본 글에서 거론된 주식의 매수,매도는 투자자 본인의 판단이며 그 결과 또한 투자자 본인의 책임입니다.

'미국주식' 카테고리의 다른 글

| 금 온스당 4,000불까지 갈까?_미국주식x미국개미 (0) | 2020.08.10 |

|---|---|

| 중국 전기차 Xpeng Motors 상장신청_미국주식x미국개미 (1) | 2020.08.10 |

| 텔라닥(TDOC) 리봉고와 합병이후 어떻게될까?_미국주식x미국개미 (0) | 2020.08.10 |

| 엣지컴퓨팅 패스틀리(FSLY) 정보_미국주식x미국개미 (0) | 2020.08.08 |

| 온라인 중고차판매 플랫폼 카바나(CVNA) 정보_미국주식x미국개미 (0) | 2020.08.07 |