선요약 : 골드만삭스는 2021년 1분기 '명절 쇼핑리스트'에서 이들 19개 주식을 매입한다고 밝혔다.

어떤 해의 최악의 실적이 있는 주식은 투자자들이 싼 물건을 찾아 회복에 베팅하면서 다음 해 초에 반등하는 경우가 많다.

알렉스 마인텔은 무역은 최근 불안한 결과를 낳았지만 시장과 경제가 회복 모드에 있는 2021년에는 작동해야 한다고 말한다.

그는 추가적인 상승이 있는 주식이나 투자자들의 성공 가능성을 향상시킬 수 있는 더 강한 수익 잠재력을 가진 주식들을 식별한다.

1년 중 최악의 실적을 거둔 종목들이 새해 벽두에는 아마 랠리할 것이라는 일종의 '하락은 반드시 올라야 한다'는 룰이 있다.

골드만삭스의 알렉스 마인텔은 이 규칙이 지난 몇 년간 항상 지켜지지 않았다는 것을 인정하지만, 그는 2020년 가장 큰 타격을 입은 기업들이 2021년 첫 3개월 안에 다시 돌아올 것이라고 생각할 충분한 이유가 있다고 말한다. 하나는 간단하다. 다른 종목에 비해 시장 최악의 주가가 이렇게 나빠진 것은 오랜만이다.

그는 고객들에게 보낸 쪽지에서 "2007년 이후 최악의 YTD 상대적 성과를 보인 2020년 지연과 이미 수면 아래에서 시작된 역전이 겹치면서 이러한 변화를 뒷받침할 근본적인 이유가 어디에 있는지를 중심으로 투자자들의 집중도가 높을 것으로 기대한다"고 썼다.

2019년 최악의 실적을 낸 것은 대유행이 닥친 1분기(46월)에 시장이 폭주하면서 2020년 들어 효과가 없었다. 하지만 세계 경제가 침체에서 다시 부상하고 있는 가운데 마인텔은 2021년 초에 반등할 때 훨씬 더 좋은 샷을 가진 기업을 찾기 위해 일련의 방법을 사용하고 있다고 말한다.

그는 1분기에 가장 유망한 회복 후보자들은 6개 테마 중 적어도 하나를 반영하고 있다고 말한다. 첫 번째 그룹은 매력적인 수준에서 거래되는 "가치" 선택으로 구성되며 분석가들이 그들의 추정치를 높임으로써 지속 가능한 회복을 경험할 수 있다.

그는 2그룹을 2021년 마진이 다시 살아날 수 있기 때문에 '코일 스프링'이라고 부르면서 정서가 개선될 수 있다. 골드만삭스의 분석가들은 골드만삭스의 수익과 수익이 다른 기업들보다 더 강한 회복세를 보일 것이라고 생각하기 때문에 "성장"이라고 불리는 다른 사례에서 월스트리트의 분석가들은 대부분의 분석가들보다 낙관적이다.

마인텔의 리스트에 올라 있는 또 다른 지체는 골드만삭스가 기업에 대해 매우 긍정적이고 "매수" 등급을 부여한 "합의를 벗어난 매수"이며, 분석가의 대다수는 회사의 2021년 실적이 합의보다 훨씬 더 좋을 것으로 예상하는 "중립" 또는 "매수" 주제가 있다.

골드만 '품질' 측정의 상위 20%에 속하는 잠재적 회복 주식 비율의 최종 그룹.

이어지는 19개 종목은 마인텔이 이 테마들을 가장 잘 보여주는 사례로, 그가 이들 테마들의 회복을 낙관하는 구체적인 이유가 슬라이드마다 이름이 붙어 있다. 이 종목들은 12월 1일 현재 골드만삭스의 가격 목표치 상향을 기준으로 최하위에서 최고로 순위가 매겨져 있다.

19. SL Green SL그린

Ticker: SLG

Sector: Real estate

Market cap: $4.2 billion

Why it will bounce back: Differentiated Buy

Upside to target: 14%

Source: Goldman Sachs

18. Boeing 보잉

Ticker: BA

Sector: Industrials

Market cap: $120.5 billion

Why it will bounce back: Above consensus

Upside to target: 16%

Source: Goldman Sachs

17. CommScope 컴스콥

Ticker: COMM

Sector: Information technology

Market cap: $2.5 billion

Why it will bounce back: Above consensus

Upside to target: 18%

Source: Goldman Sachs

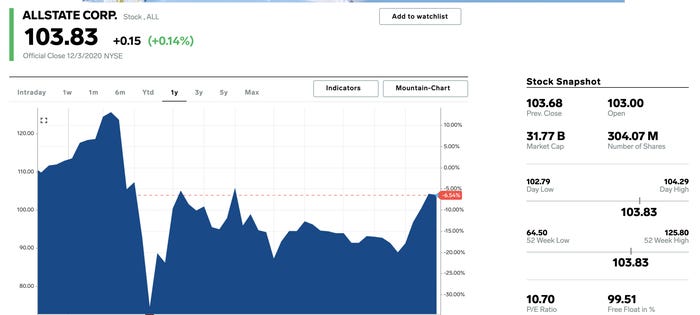

16. Allstate 올스테이트

Ticker: ALL

Sector: Financials

Market cap: $31.8 billion

Why it will bounce back: Above consensus

Upside to target: 18%

Source: Goldman Sachs

15. Becton Dickinson 벡톤티킨슨

Ticker: BDX

Sector: Healthcare

Market cap: $69.3 billion

Why it will bounce back: Coiled spring

Upside to target: 19%

Source: Goldman Sachs

14. Oshkosh 오시코시

Ticker: OSK

Sector: Industrials

Market cap: $5.6 billion

Why it will bounce back: Above consensus

Upside to target: 19%

Source: Goldman Sachs

13. Allison Transmission Holdings 앨리슨트랜스미션홀딩스

Ticker: ALSN

Sector: Industrials

Market cap: $4.6 billion

Why it will bounce back: Value with upside

Upside to target: 21%

Source: Goldman Sachs

12. Leggett & Platt 레겟&플랫

Ticker: LEG

Sector: Consumer discretionary

Market cap: $5.7 billion

Why it will bounce back: Coiled spring

Upside to target: 21%

Source: Goldman Sachs

11. Brixmor Property Group 브릭스모어 프로퍼티 그룹

Ticker: BRX

Sector: Real estate

Market cap: $4.6 billion

Why it will bounce back: Value with upside

Upside to target: 24%

Source: Goldman Sachs

10. CACI International CACI인터네셔널

Ticker: CACI

Sector: Information technology

Market cap: $6.1 billion

Why it will bounce back: Growth

Upside to target: 26%

Source: Goldman Sachs

9. Magnolia Oil & Gas 매그놀리아 오일 & 가스

Ticker: MGY

Sector: Energy

Market cap: $1.6 billion

Why it will bounce back: Growth

Upside to target: 28%

Source: Goldman Sachs

8. Simon Property Group 사이먼프로퍼티그룹

Ticker: SPG

Sector: Real estate

Market cap: $28.9 billion

Why it will bounce back: High quality

Upside to target: 28%

Source: Goldman Sachs

7. Energy Transfer 에너지트랜스퍼

Ticker: ET

Sector: Energy

Market cap: $17.1 billion

Why it will bounce back: Value with upside

Upside to target: 29%

Source: Goldman Sachs

6. Accel Entertainment 액셀엔터테인먼트

Ticker: ACEL

Sector: Consumer discretionary

Market cap: $968 million

Why it will bounce back: Coiled spring

Upside to target: 29%

Source: Goldman Sachs

5. AssetMark Financial Holdings 에셋마크파이낸셜홀딩스

Ticker: AMK

Sector: Financials

Market cap: $1.7 billion

Why it will bounce back: Growth

Upside to target: 32%

Source: Goldman Sachs

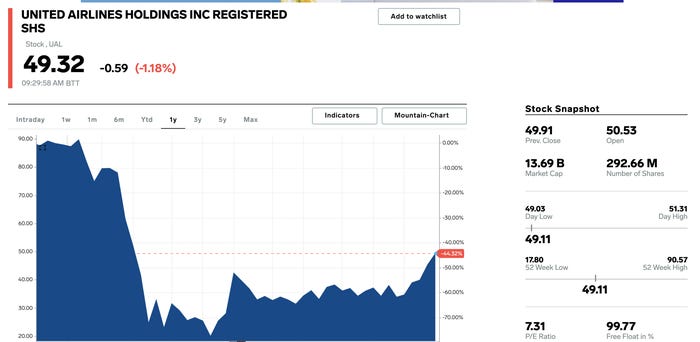

4. United Airlines 유나이티드에어라인

Ticker: UAL

Sector: Industrials

Market cap: $13.7 billion

Why it will bounce back: Differentiated Buy

Upside to target: 33%

Source: Goldman Sachs

3. Halliburton 할리버튼

Ticker: HAL

Sector: Energy

Market cap: $15.6 billion

Why it will bounce back: Differentiated Buy

Upside to target: 36%

Source: Goldman Sachs

2. Schneider National 슈나이더 네셔널

Ticker: SNDR

Sector: Industrials

Market cap: $3.7 billion

Why it will bounce back: High quality

Upside to target: 44%

Source: Goldman Sachs

1. Incyte 인사이트

Ticker: INCY

Sector: Healthcare

Market cap: $18.0 billion

Why it will bounce back: High quality

Upside to target: 57%

Source: Goldman Sachs

#출처 : Businessinsider.com

# 본 글은 주식 매수 매도 추천글이 아닙니다. 본 글에서 거론된 주식의 매수,매도는 투자자 본인의 판단이며 그 결과 또한 투자자 본인의 책임입니다.

'미국주식' 카테고리의 다른 글

| 버진갤럭틱(SPCE) 새로운 우주 비행을 며칠 앞두고 승무원 유니폼 공개_미국주식x미국개미 (0) | 2020.12.08 |

|---|---|

| AT&T(T):주가전망 및 HBO MAX정보_미국주식x미국개미 (4) | 2020.12.07 |

| 월마트(WMT) : 라이브 드론 쇼 스트리밍 실시간 보기_미국주식x미국개미 (8) | 2020.12.06 |

| 테슬라(TSLA)의 12월18일 쿼드러플위칭데이는 과연...?_미국주식x미국개미 (5) | 2020.12.06 |

| 펫코(WOOF): IPO신청_미국주식x미국개미 (0) | 2020.12.05 |