선요약 : 제프리스 Jefferies Equity Research가 추천한 22종목이 무엇인지만 알아봅시다.

1. 액티비전 블리자드 Activision Blizzard

Ticker : ATVI

Sector : Communication services

Price target : $ 80

Upside : 10.2%

Quote : "Best-in-class gaming company with a visible path to two straight years of earnings growth and call-options not reflected in the current valuation. ... The market is missing ATVI's aggressive pursuit of mobile gaming and how it will impact the future financial trajectory of the company. "

Source: Jefferies Equity Research

2. 바이오-래드 래보라토리즈 Bio-Rad Laboratories

Ticker : BIO

Sector : Healthcare

Price target : $ 525

Upside : 11.8%

Quote : "BIO has a fundamentally strong business that has proven to be resilient thru economic cycles, having delivered positive organic growth every Q for 10+ years, even through the (Global Financial Crisis) in '08 / 09."

Source: Jefferies Equity Research

3. 바이오마린 BioMarin

Ticker : BMRN

Sector : Healthcare

Price target : $ 132

Upside : 38.1%

Quote : "BMRN focuses on drugs primarily for rare diseases for which no / limited therapies are available. In addition, its diversified pipeline in various niche rare disease markets and biologics focus pose a high barrier for generic entry."

Source: Jefferies Equity Research

4. 블랙스톤 Blackstone

Ticker : BX

Sector : Financials

Price target : $ 56

Upside : 4.6%

Quote : "BX is trading at a 2-3 turn discount to pre-Covid levels despite having completed its most recent round of flagship fundraising and actively deploying capital."

Source: Jefferies Equity Research

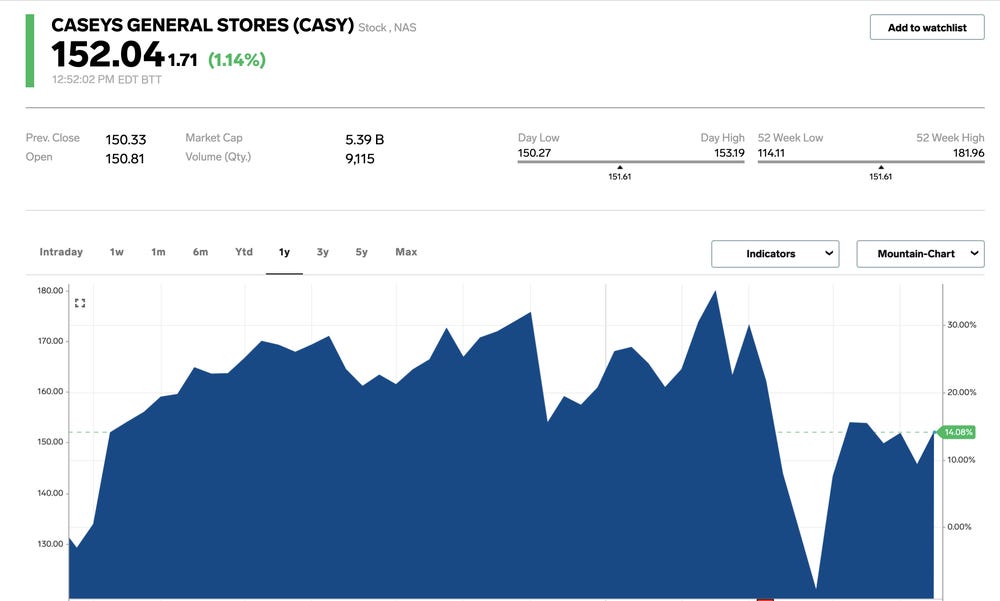

5. 캐시스 제너럴 스토어즈 Casey's General Stores

Ticker : CASY

Sector : Consumer staples

Price target : $ 175

Upside : 15.2%

Quote : "We continue to like CASY due to its superior foodservice offering and self-help initiatives that should help deliver solid mkt. Share gains and robust EBITDA growth."

Source: Jefferies Equity Research

6. 쉐브론 Chevron

Ticker : CVX

Sector : Energy

Price target : $ 100

Upside : 11%

Quote : "The company has significantly more financial flexibility than its peers due to the balance sheet and low break-even price."

Source: Jefferies Equity Research

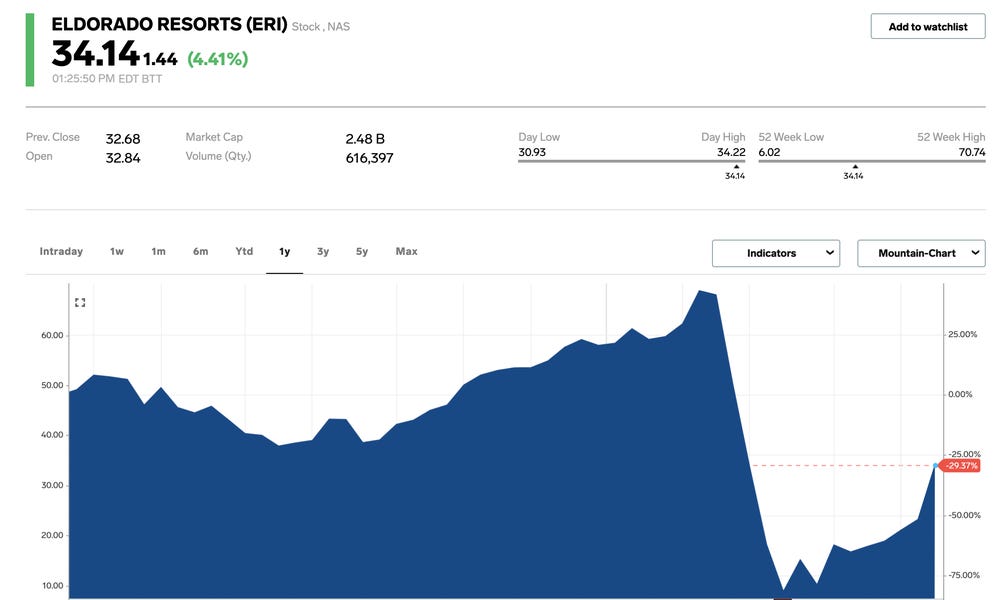

7. 엘도라도 리조트 Eldorado Resorts

Ticker : ERI

Sector : Consumer discretionary

Price target : $ 38

Upside : 11.3%

Quote : "The result (of the Eldorado-Caesars Entertainment deal) should be better profitability, which becomes simpler coming out of the shutdown, capture from excess asset value and a sports and iGaming presence that pushes valuation higher."

Source: Jefferies Equity Research

8. 젠텍스 Gentex

Ticker : GNTX

Sector : Consumer discretionary

Price target : $ 29

Upside : 14%

Quote : "Despite industry uncertainty due to COVID-19, favorable mix and encouraging operational color suggest GNTX will continue to outperform peers."

Source: Jefferies Equity Research

9. 알파벳 (구글) Alphabet

Ticker : GOOGL

Sector : Communication services

Price target : $ 1,450

Upside : 3.1%

Quote : "We believe it is not getting full credit for call options in place for both the near and longer term, including Google Cloud Platform, AI, hardware (Google Home, Pixel), YouTube TV (subscriptions), and Waymo."

Source: Jefferies Equity Research

10. 해모네틱스 Haemonetics

Ticker : HAE

Sector : Healthcare

Price target : $ 165

Upside : 54.1%

Quote : "The impact to plasma collections due to social distancing has only worked to further enhance the value proposition behind NexSys, which is also the only solution on the market that is proven to increase yields with each donation."

Source: Jefferies Equity Research

11. 해스브로 Hasbro

Ticker : HAS

Sector : Consumer discretionary

Price target : $ 88

Upside : 30.7%

Quote : "The toy business provides a stable cash flow mechanism fueling higher growth, higher structural margin content, and gaming engines."

Source: Jefferies Equity Research

12. 헌츠맨 Huntsman

Ticker : HUN

Sector : Materials

Price target : $ 25

Upside : 45%

Quote : "Huntsman combines operating leverage to a recovery in construction and automotive markets, significant regional exposure in China, a stronger balance sheet than any time since long before its IPO, and an operating culture focused on improving FCF and FCF conversion."

Source: Jefferies Equity Research

13. 켄너메탈 Kennametal

Ticker : KMT

Sector : Industrials

Price target : $ 30

Upside : 17.4%

Quote : "The company operates in a benign global oligopoly where competitors consistently have high margins, and KMT has implemented restructuring and modernization that will allow it to close the margin gap with peers."

Source: Jefferies Equity Research

14. 로우스 Lowe's

Ticker : LOW

Sector : Consumer discretionary

Price target : $ 135

Upside : 10.3%

Quote : "We believe the market underappreciates tailwinds associated with the retailer's revamped Pro Loyalty program."

Source: Jefferies Equity Research

15. 마틴 마리에타 머티리얼즈 Martin Marietta Materials

Ticker : MLM

Sector : Materials

Price target : $ 221

Upside : 23.9%

Quote : "With the pricing story intact with (aggregates) and cement pricing accelerating in April, and potential upside from a LT infrastructure bill, we continue to find MLM a compelling quality defensive name."

Source: Jefferies Equity Research

16. 마라톤 페트롤리엄 Marathon Petroleum

Ticker : MPC

Sector : Energy

Price target : $ 47

Upside : 33%

Quote : "There are many aspects of the story which stand to be clarified and improved in coming quarters that we believe will translate into a higher equity valuation. We also favor the way MPC is vertically integrated."

Source: Jefferies Equity Research

17. 모토롤라 솔루션스 Motorola Solutions

Ticker : MSI

Sector : Information technology

Price target : $ 155

Upside : 15.3%

Quote : "Motorola Solutions is the dominant provider of mission-critical Public Safety infrastructure and handsets globally. Moreover, there are major barriers to entry around this business – both competitively and technologically."

Source: Jefferies Equity Research

18. 리오틴토 Rio Tinto

Ticker : RIO

Sector : Materials

Price target : $ 55

Upside : 5.5%

Quote : "These shares have historically been defensive in downturns and outperformed the markets in upturns, offering a favorable risk / reward tradeoff, especially for longer term investors."

Source: Jefferies Equity Research

19. 링센트럴 RingCentral

Ticker : RNG

Sector : Information technology

Price target : $ 290

Upside : 10.9%

Quote : "RNG's partnership with AVYA changed the landscape of the industry and structurally advantages RNG vs. other (unified communications as a service) providers."

Source: Jefferies Equity Research

20. 레이시온 테크놀로지스 Raytheon Technologies

Ticker : RTX

Sector : Industrials

Price target : $ 80

Upside : 33.2%

Quote : "Shares should move upwards as the cash flow outlook becomes better understood. ... Any recovery in air travel or improvement in sentiment would help drive the commercial Aerospace business (~ 25% of sales)."

Source: Jefferies Equity Research

21.티제이엑스 TJX

Ticker : TJX

Sector : Consumer discretionary

Price target : $ 60

Upside : 11.9%

Quote : "On the supply side, TJX should see unprecedented inventory availability with favorable pricing, fueling access to better brands while supporting margins. On the demand side, TJX should benefit from the consumer trade-down towards its value offering."

Source: Jefferies Equity Research

22. 텍사스인스트루먼트 Texas Instruments

Ticker : TXN

Sector : Information technology

Price target : $ 136

Upside : 20.2%

Quote : "We would expect demand from industrial and automotive markets to reaccelerate, and TXN to post levered earnings surprises on revenue growth."

Source: Jefferies Equity Research

2020/05/25 - [미국주식] - 채권을 잊어라! _ 배당과 성장을 제공하는 5 가지 안전한 기술주! _ 미국주식 X 미국개미

채권을 잊어라! _ 배당과 성장을 제공하는 5 가지 안전한 기술주! _ 미국주식 X 미국개미

선요약 : 알트만-Z 스코어를 기준으로 선정한 5개 테크주 (인텔, 텍사스 인스트루먼트, 퀄컴, 코그니잔트 테크놀로지 솔루션스, 아날로그 디바이시스) 고려해야 할 5 가지 주식이 있습니다. 저는 �

usant.tistory.com

# 본 글은 주식 매수 매도 추천글이 아닙니다. 본 글에서 거론된 주식의 매수,매도는 투자자 본인의 판단이며 그 결과 또한 투자자 본인의 책임입니다.

'미국주식' 카테고리의 다른 글

| 루이싱커피 Luckin coffee 주식 급등한 이유 _ 미국주식 X 미국개미 (0) | 2020.05.27 |

|---|---|

| 미국 광산업 대장 뉴몬트,서던카퍼,프리포트맥머란카퍼앤골드,뉴코어 비교 _ 미국주식 X 미국개미 (2) | 2020.05.26 |

| 100년 이상 배당금을 준 미국기업 _ 미국주식 X 미국개미 (0) | 2020.05.26 |

| 자일링스(XLNX) vs 스카이웍스(SWKS) 비교 _ 미국주식 X 미국개미 (0) | 2020.05.26 |

| 에머슨 일렉트릭, 아메리칸 익스프레스, 제너럴 다이나믹스 _ 미국주식 X 미국개미 (0) | 2020.05.26 |