선요약 : 골드만삭스는 2021년 회복되기 전에 지금 이 20개 주식을 매수하라고 한다. 너무 자주 추천하는거 아닌가? ...과연?

투자자들은 화이저의 실험용 COVID-19 백신을 업데이트한 후 값싼 '가치' 종목에 뛰어들었고 골드만삭스의 데이비드 코스틴은 이것이 오랫동안 기다려온 시장의 전환의 시작이라고 말한다.

코스틴은 회사 실적도 예상보다 크게 좋아 2021년과 2022년에는 주가가 오르는 데 도움이 될 것이라고 말한다.

그런 점을 염두에 두고, 월가에서는 2019년에 비해 2021년에 절반도 못 버는 것으로 가정하고 있음에도 불구하고 경기가 회복됨에 따라 잘 나갈거 같은 종목이라고 한다.

20. DXC Technology DXC테크놀로지

Ticker: DXC

Sector: Information technology

Market cap: $5.4 billion

Year to date performance: -46.0%

Expected 2021 earnings as a percentage of 2019 earnings: 46%

Source: Goldman Sachs

19. Wells Fargo 웰스파고

Ticker: WFC

Sector: Financials

Market cap: $100.1 billion

Year to date performance: -55.7%

Expected 2021 earnings as a percentage of 2019 earnings: 45%

Source: Goldman Sachs

18. Marriott International 매리어트인터네셔널

Ticker: MAR

Sector: Consumer discretionary

Market cap: $37.8 billion

Year to date performance: -23.8%

Expected 2021 earnings as a percentage of 2019 earnings: 42%

Source: Goldman Sachs

17. Raytheon Technologies 레이시온테크놀로지

Ticker: RTX

Sector: Industrials

Market cap: $100.1 billion

Year to date performance: -26.4%

Expected 2021 earnings as a percentage of 2019 earnings: 42%

Source: Goldman Sachs

16. Chevron 쉐브론

Ticker: CVX

Sector: Energy

Market cap: $158.9 billion

Year to date performance: -33.1%

Expected 2021 earnings as a percentage of 2019 earnings: 41%

Source: Goldman Sachs

15. Howmet Aerospace 호멧에어로스페이스

Ticker: HWM

Sector: Industrials

Market cap: $9.7 billion

Year to date performance: -30.3%

Expected 2021 earnings as a percentage of 2019 earnings: 39%

Source: Goldman Sachs

14. Phillips 66 필립스66

Ticker: PSX

Sector: Energy

Market cap: $25.8 billion

Year to date performance: -50.8%

Expected 2021 earnings as a percentage of 2019 earnings: 39%

Source: Goldman Sachs

13. EOG Resources EOG리소시스

Ticker: EOG

Sector: Energy

Market cap: $24.5 billion

Year to date performance: -51.7%

Expected 2021 earnings as a percentage of 2019 earnings: 39%

Source: Goldman Sachs

12. Devon Energy 데본에너지

Ticker: DVN

Sector: Energy

Market cap: $4.5 billion

Year to date performance: -56.5%

Expected 2021 earnings as a percentage of 2019 earnings: 39%

Source: Goldman Sachs

11. ConocoPhillips 코노코필립스

Ticker: COP

Sector: Energy

Market cap: $37.7 billion

Year to date performance: -47.7%

Expected 2021 earnings as a percentage of 2019 earnings: 18%

Source: Goldman Sachs

10. Valero Energy 발레로에너지

Ticker: VLO

Sector: Energy

Market cap: $20.3 billion

Year to date performance: -49.5%

Expected 2021 earnings as a percentage of 2019 earnings: 17%

Source: Goldman Sachs

9. HollyFrontier 홀리프론티어

Ticker: HFC

Sector: Energy

Market cap: $3.5 billion

Year to date performance: -59.2%

Expected 2021 earnings as a percentage of 2019 earnings: 12%

Source: Goldman Sachs

8. Host Hotels & Resorts 호스트호텔앤리조트

Ticker: HST

Sector: Real estate

Market cap: $9.1 billion

Year to date performance: -43.3%

Expected 2021 earnings as a percentage of 2019 earnings: 10%

Source: Goldman Sachs

7. Southwest Airlines 사우스웨스트에어라인

Ticker: LUV

Sector: Industrials

Market cap: $25.5 billion

Year to date performance: -22.3%

Expected 2021 earnings as a percentage of 2019 earnings: 9%

Source: Goldman Sachs

6. Expedia Group 익스피디아그룹

Ticker: EXPE

Sector: Consumer discretionary

Market cap: $17.0 billion

Year to date performance: +8.7%

Expected 2021 earnings as a percentage of 2019 earnings: 4%

Source: Goldman Sachs

5. Alaska Air Group 알래스카에어그룹

Ticker: ALK

Sector: Industrials

Market cap: $5.5 billion

Year to date performance: -37.4%

Expected 2021 earnings as a percentage of 2019 earnings: -3%

Source: Goldman Sachs

4. Delta Air Lines 델타에어라인

Ticker: DAL

Sector: Industrials

Market cap: $22.4 billion

Year to date performance: -41.2%

Expected 2021 earnings as a percentage of 2019 earnings: -5%

Source: Goldman Sachs

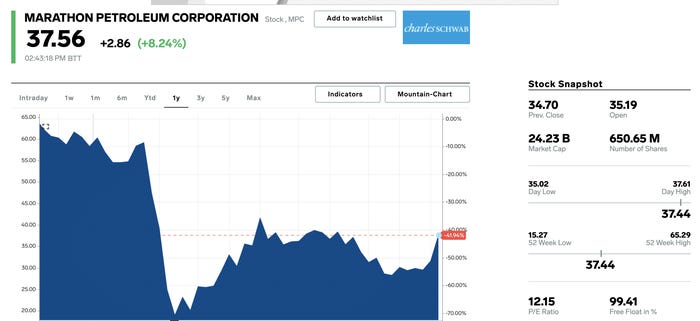

3. Marathon Petroleum 마라톤페트롤리엄

Ticker: MPC

Sector: Energy

Market cap: $24.2 billion

Year to date performance:

Expected 2021 earnings as a percentage of 2019 earnings: -12%

Source: Goldman Sachs

2. United Airlines 유나이티드에어라인

Ticker: UAL

Sector: Industrials

Market cap: $11.2 billion

Year to date performance: -60.6%

Expected 2021 earnings as a percentage of 2019 earnings: -35%

Source: Goldman Sachs

1. Carnival Corp 카니발

Ticker: CCL

Sector: Consumer discretionary

Market cap: $14.2 billion

Year to date performance: -70.6%

Expected 2021 earnings as a percentage of 2019 earnings: -82%

Source: Goldman Sachs

#출처 : www.businessinsider.com/stock-picks-to-buy-cheap-companies-value-economic-rebound-goldman-2020-11#1-carnival-corp-20

# 본 글은 주식 매수 매도 추천글이 아닙니다. 본 글에서 거론된 주식의 매수,매도는 투자자 본인의 판단이며 그 결과 또한 투자자 본인의 책임입니다.

'미국주식' 카테고리의 다른 글

| 프록터앤갬블(PG)배당금,배당일정,주가정보_미국주식x미국개미 (4) | 2020.11.18 |

|---|---|

| RBC 디지털 헬스케어 기술주 선정_미국주식x미국개미 (3) | 2020.11.18 |

| 워렌버핏 4개 제약회사 매수_미국주식x미국개미 (3) | 2020.11.17 |

| 에어비앤비(Airbnb) 상장IPO 공모신청_미국주식x미국개미 (4) | 2020.11.17 |

| 테슬라(TSLA):S&P500 편입시기일정_미국주식x미국개미 (3) | 2020.11.17 |