반응형

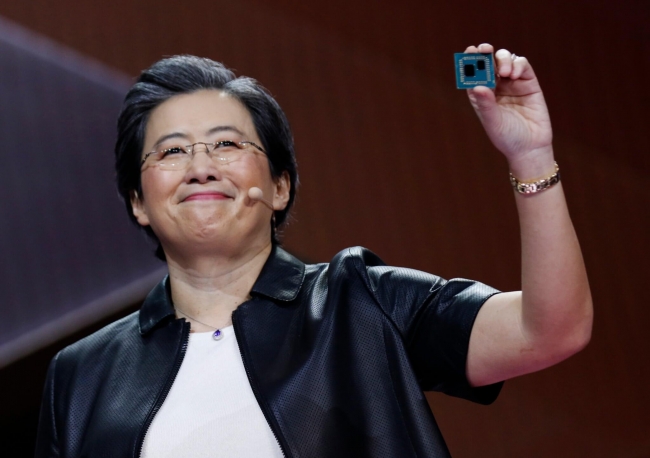

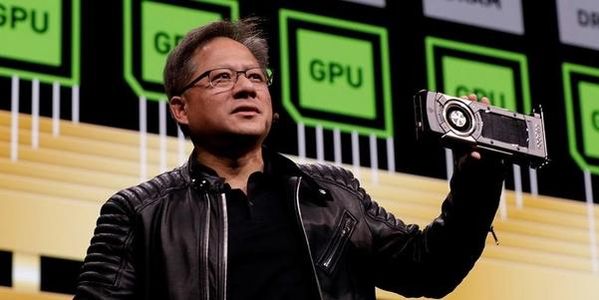

선요약 : 나스닥100에 포함된 전체주식의 5년 수익률 순위표. 과거가 미래를 보장하는 것은 아님. 5년수익률 1위 AMD(AMD), 2위 엔비디아(NVDA), 3위 테슬라(TSLA).

| 티커 | 회사명 | 섹터 | 주가 | 배당률 | 1주당 배당금(TTM) | 시가총액(백만$) | Forward P/E Ratio | 5년 수익률 |

| AMD | Advanced Micro Devices Inc. | Technology | 94.7 | 0.0% | 0 | 115062.4864 | 39.91067861 | 1,767.9% |

| NVDA | NVIDIA Corp 엔비디아 |

Technology | 819.48 | 0.6% | 0.639732397 | 510536.04 | 95.83931669 | 1,684.8% |

| TSLA | Tesla Inc 테슬라 |

Consumer Cyclical | 678.9 | 0.0% | 0 | 654005.0411 | 588.1340298 | 1,467.9% |

| MELI | MercadoLibre Inc 메르카도리브레 |

Consumer Cyclical | 1551.96 | 1.5% | 0 | 77368.805 | N/A | 1,014.6% |

| LRCX | Lam Research Corp. 램리서치 |

Technology | 631.44 | 1.8% | 5.182610415 | 90055.55984 | 26.02405331 | 727.1% |

| PYPL | PayPal Holdings Inc 페이팔 |

Financial Services | 290.24 | 0.0% | 0 | 340953.0704 | 65.37930401 | 698.5% |

| ALGN | Align Technology, Inc. 얼라인테크놀로지 |

Healthcare | 624.17 | 0.0% | 0 | 49394.67602 | 107.8173282 | 656.2% |

| ASML | ASML Holding NV | Technology | 687.54 | 0.0% | 3.261363529 | 288421.3029 | 52.47060692 | 631.5% |

| IDXX | Idexx Laboratories 이덱스 |

Healthcare | 648.2 | 0.7% | 0 | 55278.91992 | 81.99114206 | 596.5% |

| MU | Micron Technology 마이크론 |

Technology | 80.33 | 0.0% | 0 | 90431.78348 | 21.90161867 | 542.6% |

| AAPL | Apple Inc 애플 |

Technology | 139.96 | 2.8% | 0.832994372 | 2335600.835 | 30.60634554 | 525.% |

| ADBE | Adobe Inc 어도비 |

Technology | 593.07 | 0.0% | 0 | 282538.548 | 50.61600645 | 522.2% |

| AMAT | Applied Materials Inc. 어플라이드머티리얼 |

Technology | 138.16 | 0.5% | 0.897367425 | 126275.5812 | 28.49178277 | 515.3% |

| MSFT | Microsoft Corporation 마이크로소프트 | Technology | 277.65 | 0.5% | 2.182466166 | 2091141.674 | 37.33181602 | 489.1% |

| CDNS | Cadence Design Systems, Inc. 캐덴스디자인시스템 |

Technology | 137.94 | 3.1% | 0 | 38383.8741 | 58.70664796 | 465.8% |

| NFLX | NetFlix Inc 넷플릭스 |

Communication Services | 533.98 | 0.0% | 0 | 235909.6984 | 62.75791428 | 452.4% |

| ADSK | Autodesk Inc. 오토데스크 |

Technology | 297.74 | 0.0% | 0 | 65506.76441 | 50.49469237 | 447.9% |

| SNPS | Synopsys, Inc. 시놉시드 |

Technology | 279.16 | 0.0% | 0 | 42592.8102 | 52.72764323 | 419.2% |

| LULU | Lululemon Athletica inc. 룰루레몬 |

Consumer Cyclical | 368.47 | 0.0% | 0 | 46041.15887 | 65.28466157 | 398.2% |

| AMZN | Amazon.com Inc. 아마존닷컴 |

Consumer Cyclical | 3510.98 | 0.0% | 0 | 1770670.551 | 65.81684387 | 383.8% |

| KLAC | KLA Corp. | Technology | 311.82 | 1.1% | 3.583469351 | 47796.32558 | 25.74446577 | 382.% |

| TTWO | Take-Two Interactive Software, Inc. 테이크투 |

Communication Services | 177.3 | 0.0% | 0 | 20505.82529 | 34.82138358 | 367.6% |

| INTU | Intuit Inc 인튜이트 |

Technology | 497.64 | 0.0% | 2.292861243 | 136375.7498 | 64.11647852 | 365.6% |

| ISRG | Intuitive Surgical Inc 인튜이티브서지컬 |

Healthcare | 938.16 | 1.7% | 0 | 111090.235 | 94.67379837 | 322.4% |

| CTAS | Cintas Corporation 신타스 |

Industrials | 383.5 | 0.8% | 4.296207727 | 40278.99081 | 41.10512154 | 308.% |

| CSX | CSX Corp. | Industrials | 32.58 | 2.8% | 0.35873838 | 24676.09904 | 9.135912269 | 300.% |

| NTAP | Netapp Inc 넷앱 |

Technology | 82.99 | 1.1% | 1.898503531 | 18524.81153 | 25.37645415 | 286.7% |

| GOOG | Alphabet Inc 알파벳(구글) |

Communication Services | 2574.38 | 0.8% | 0 | 1738146.74 | 0 | 268.2% |

| JD | JD.com Inc 징동닷컴 |

Consumer Cyclical | 76.23 | 1.4% | 0 | 118552.1349 | 14.89220857 | 257.7% |

| AVGO | Broadcom Inc 브로드컴 |

Technology | 468.17 | 1.2% | 13.88908471 | 192071.6864 | 41.89131655 | 255.5% |

| TXN | Texas Instruments Inc. 텍사스인스트루먼트 |

Technology | 192.21 | 0.0% | 3.926006642 | 177510.4564 | 28.88697418 | 252.9% |

| GOOGL | Alphabet Inc 알파벳(구글) |

Communication Services | 2505.15 | 0.4% | 0 | 1738146.74 | 33.84044428 | 252.7% |

| TMUS | T-Mobile US Inc 티모바일 |

Communication Services | 146.29 | 1.0% | 0 | 182402.8248 | 59.88273959 | 244.7% |

| XLNX | Xilinx, Inc. 자일링스 |

Technology | 144.56 | 0.0% | 0.758923491 | 35543.94139 | 54.97834735 | 240.1% |

| ILMN | Illumina Inc 일루미나 |

Healthcare | 474.73 | 2.1% | 0 | 69310.58 | 110.0167937 | 237.3% |

| ADI | Analog Devices Inc. 아날로그디바이시스 |

Technology | 170.67 | 0.0% | 2.603897042 | 62947.6901 | 40.33518202 | 234.2% |

| MXIM | Maxim Integrated Products, Inc. 맥심인터그레이티드프로덕츠 |

Technology | 104.03 | 0.0% | 0.479999989 | 27917.87093 | 35.75455409 | 232.4% |

| SWKS | Skyworks Solutions, Inc. 스카이웍스 |

Technology | 191.32 | 1.3% | 1.991060102 | 31585.50322 | 26.08432011 | 230.3% |

| NTES | NetEase Inc 넷이스 |

Communication Services | 113.31 | 1.2% | 0.849670018 | 76028.82062 | 37.61118246 | 226.7% |

| WDAY | Workday Inc 워크데이 |

Technology | 238.3 | 4.1% | 0 | 45038.7 | N/A | 220.6% |

| MCHP | Microchip Technology, Inc. 마이크로칩테크놀로지 |

Technology | 148.25 | 0.0% | 1.533424678 | 40551.03138 | 116.059048 | 218.% |

| CHTR | Charter Communications Inc. 차터커뮤니케이션 |

Communication Services | 731.92 | 0.0% | 0 | 138088.5358 | 38.00950615 | 215.1% |

| FB | Facebook Inc 페이스북 |

Communication Services | 354.7 | 2.8% | 0 | 1012313.845 | 30.00248497 | 210.6% |

| ULTA | Ulta Beauty Inc 울타뷰티 |

Consumer Cyclical | 351.9 | 0.0% | 0 | 19269.18396 | 39.76036291 | 209.1% |

| QCOM | Qualcomm, Inc. 퀄컴 |

Technology | 142.58 | 0.0% | 2.641047282 | 160830.24 | 20.04864622 | 207.8% |

| EBAY | EBay Inc. 이베이 |

Consumer Cyclical | 70.08 | 0.0% | 0.676983969 | 47742.81545 | 16.48577882 | 204.1% |

| COST | Costco Wholesale Corp 코스트코 |

Consumer Defensive | 398.94 | 0.0% | 2.845866678 | 176359.0432 | 37.31676749 | 186.9% |

| VRSN | Verisign Inc. 베리사인 |

Technology | 231.33 | 2.4% | 0 | 26052.10793 | 41.27877465 | 171.1% |

| NXPI | NXP Semiconductors NV | Technology | 202.73 | 0.5% | 1.868207631 | 55902.86197 | 131.2273755 | 169.7% |

| FAST | Fastenal Co. 패스널 |

Industrials | 52.6 | 0.0% | 1.047419878 | 30216.72892 | 34.84803243 | 167.7% |

| ATVI | Activision Blizzard Inc 액티비전블리자드 |

Communication Services | 94.27 | 0.7% | 0.469999999 | 73249.36987 | 31.69596273 | 145.4% |

| ADP | Automatic Data Processing Inc. 오토매틱데이터프로세싱 |

Industrials | 201.48 | 0.0% | 3.672827117 | 85733.43111 | 34.68321175 | 142.2% |

| ROST | Ross Stores, Inc. 로스스토어 |

Consumer Cyclical | 126.25 | 4.0% | 0.569320197 | 45086.48421 | 51.96073335 | 133.1% |

| VRTX | Vertex Pharmaceuticals, Inc. 버텍스파마 |

Healthcare | 200.54 | 1.2% | 0 | 51912.92166 | 18.79519197 | 128.6% |

| VRSK | Verisk Analytics Inc 베리스크애널리틱스 |

Industrials | 177.5 | 0.0% | 1.117324937 | 28771.18907 | 40.54564412 | 123.% |

| SBUX | Starbucks Corp. 스타벅스 |

Consumer Cyclical | 114.97 | 0.0% | 1.749268493 | 135354.181 | 135.9250663 | 122.2% |

| MAR | Marriott International, Inc. 메리어트 |

Consumer Cyclical | 141.26 | 0.8% | 0 | 45826.74283 | 203.6744126 | 119.3% |

| PAYX | Paychex Inc. 페이첵스 |

Industrials | 108.73 | 0.0% | 2.494606005 | 39181.95019 | 37.13224999 | 114.1% |

| CSCO | Cisco Systems, Inc. 시스코 |

Technology | 53.54 | 0.0% | 1.444507756 | 225628.5165 | 22.08147548 | 113.9% |

| JBHT | J.B. Hunt Transport Services, Inc. JB헌트트랜스포트 |

Industrials | 165.31 | 1.1% | 1.116921369 | 17468.474 | 31.88800801 | 112.7% |

| ORLY | O`Reilly Automotive, Inc. 오레일리오토모티브 |

Consumer Cyclical | 581.88 | 2.1% | 0 | 40592.91239 | 20.77986867 | 112.2% |

| PCAR | Paccar Inc. 패커 |

Industrials | 88.3 | 0.0% | 1.288236799 | 30653.90986 | 21.75424729 | 100.9% |

| WLTW | Willis Towers Watson Public Limited Co 윌리스타워스왓슨 |

Financial Services | 231.7 | 0.0% | 2.79776123 | 29883.91344 | 20.98589427 | 100.8% |

| FISV | Fiserv, Inc. 파이서브 |

Technology | 109.27 | 0.8% | 0 | 72857.89037 | 83.74470158 | 100.7% |

| INTC | Intel Corp. 인텔 |

Technology | 56.76 | 0.0% | 1.342535603 | 229196.88 | 12.32307543 | 97.2% |

| CTXS | Citrix Systems, Inc. 시트릭스 |

Technology | 118.93 | 0.5% | 1.433754743 | 14767.18666 | 35.73236673 | 91.7% |

| EA | Electronic Arts, Inc. 일렉트로닉아츠 |

Communication Services | 143.41 | 0.0% | 0.509789443 | 41042.67655 | 49.03545585 | 89.5% |

| AMGN | AMGEN Inc. 암젠 |

Healthcare | 248.7 | 2.4% | 6.651274258 | 142891.5763 | 20.16818297 | 85.6% |

| BKNG | Booking Holdings Inc 부킹홀딩스 |

Consumer Cyclical | 2238.89 | 0.7% | 0 | 91912.7325 | 130.743574 | 76.7% |

| SIRI | Sirius XM Holdings Inc 시리우스XM |

Communication Services | 6.63 | 0.1% | 0.057029212 | 27121.77897 | 430.5044281 | 73.7% |

| XEL | Xcel Energy, Inc. 엑셀에너지 |

Utilities | 66.82 | 0.9% | 1.757226062 | 35962.97838 | 23.35258336 | 73.% |

| WDC | Western Digital Corp. 웨스턴디지털 |

Technology | 70.21 | 0.0% | 0 | 21516.05713 | 62.00592832 | 71.3% |

| MNST | Monster Beverage Corp. 몬스터비버리지 |

Consumer Defensive | 90.86 | 2.4% | 0 | 48025.16304 | 33.21350212 | 70.7% |

| REGN | Regeneron Pharmaceuticals, Inc. 리제네론파마 |

Healthcare | 583.64 | 1.5% | 0 | 61104.0935 | 15.26152493 | 62.8% |

| PEP | PepsiCo Inc 펩시코 |

Consumer Defensive | 148.91 | 2.9% | 4.097057557 | 205738.7115 | 27.44646632 | 62.1% |

| EXPE | Expedia Group Inc 익스피디아 |

Consumer Cyclical | 167.42 | 0.0% | 0 | 23681.08286 | N/A | 61.6% |

| ALXN | Alexion Pharmaceuticals Inc. 알렉시온파마 |

Healthcare | 186.28 | 1.9% | 0 | 41171.46216 | 60.38642148 | 57.1% |

| BIIB | Biogen Inc 바이오젠 |

Healthcare | 348.72 | 0.0% | 0 | 52501.45242 | 17.4324974 | 54.6% |

| MDLZ | Mondelez International Inc. 몬델레즈 |

Consumer Defensive | 62.6 | 0.9% | 1.250327786 | 87934.92262 | 23.36830258 | 54.% |

| CHKP | Check Point Software Technolgies 체크포인트소프트웨어 |

Technology | 116.94 | 1.6% | 0 | 16038.54669 | 18.85113622 | 46.9% |

| WYNN | Wynn Resorts Ltd. 윈리조트 |

Consumer Cyclical | 121.5 | 0.9% | 0 | 14052.46195 | N/A | 44.4% |

| CERN | Cerner Corp. 서너 |

Healthcare | 79.46 | 0.0% | 0.83654727 | 23942.65422 | 29.73574168 | 38.2% |

| HAS | Hasbro, Inc. 해스브로 |

Consumer Cyclical | 96.65 | 1.0% | 2.690775393 | 13296.00683 | 32.55984198 | 32.% |

| CTSH | Cognizant Technology Solutions Corp. 코그니잔트테크놀로지솔루션스 |

Technology | 69.61 | 0.0% | 0.915692845 | 36713.14125 | 23.99551715 | 27.9% |

| UAL | United Airlines Holdings Inc 유나이티드항공 |

Industrials | 52.77 | 0.0% | 0 | 17076.94007 | 0 | 27.6% |

| BIDU | Baidu Inc 바이두 |

Communication Services | 196.7 | 0.0% | 0 | 68510.61 | 9.317095055 | 19.1% |

| HSIC | Henry Schein Inc. 헨리쉐인 |

Healthcare | 75.97 | 2.1% | 0 | 10688.68226 | 24.3184362 | 9.3% |

| DLTR | Dollar Tree Inc 달러트리 |

Consumer Defensive | 99.45 | 0.0% | 0 | 23067.81257 | 15.70521008 | 6.% |

| BMRN | Biomarin Pharmaceutical Inc. 바이오마린 |

Healthcare | 85.47 | 0.0% | 0 | 15619.00771 | 19.6443267 | 5.% |

| INCY | Incyte Corp. 인사이트 |

Healthcare | 83.58 | 0.6% | 0 | 18381.20421 | 38.41582555 | 2.8% |

| CMCSA | Comcast Corp 컴캐스트 |

Communication Services | 58.42 | 0.0% | 0.706859034 | 267846.6344 | 22.86161099 | -1.8% |

| GILD | Gilead Sciences, Inc. 길리어드사이언스 |

Healthcare | 69.3 | 0.0% | 2.736033923 | 86914.5469 | 288.7526475 | -3.% |

| FOXA | Fox Corporation 폭스 |

Communication Services | 37.32 | 3.9% | 0.458750263 | 21262.84029 | 10.53137211 | -4.9% |

| LBTYK | Liberty Global plc 리버티글로벌 |

Communication Services | 27.08 | 0.0% | 0 | 15315.06764 | 0 | -6.6% |

| FOX | Fox Corporation 폭스 |

Communication Services | 35.37 | 0.0% | 0.458678073 | 21262.84029 | 0 | -8.1% |

| LBTYA | Liberty Global plc 리버티글로벌 |

Communication Services | 27.13 | 1.2% | 0 | 15315.06764 | N/A | -8.7% |

| AAL | American Airlines Group Inc 아메리칸항공 |

Industrials | 21.48 | 0.0% | 0 | 13776.90948 | N/A | -23.8% |

| WBA | Walgreens Boots Alliance Inc 월그린부츠 |

Healthcare | 48.17 | 2.7% | 1.843907487 | 41666.43853 | 18.20290019 | -33.6% |

| KHC | Kraft Heinz Co 크래프트하인즈 |

Consumer Defensive | 40.38 | 0.5% | 1.576469711 | 49390.68959 | 91.29517484 | -43.5% |

# 본 글은 주식의 매수, 매도 추천글이 아닙니다. 따라서, 본 글에서 거론된 주식의 매수, 매도는 투자자 본인의 판단이며, 그 결과 또한 투자자 본인의 책임입니다.

# Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.

728x90

반응형

'미국주식' 카테고리의 다른 글

| 루시드모터스(LCID)45억 달러 합병, 스팸 필터로 인해 보류 중_미국주식x미국개미 (0) | 2021.07.23 |

|---|---|

| 카사바사이언스(SAVA):하이리스크 하이리턴_미국주식x미국개미 (0) | 2021.07.22 |

| 쿠퍼컴퍼니스(COO):렌즈 및 여성건강회사 주가전망, 분석, 배당정보_미국주식x미국개미 (0) | 2021.07.22 |

| 처칠캐피탈(CCIV):루시드모터스(Lucid Motors)와의 합병후 어떻게 될까?_미국주식x미국개미 (2) | 2021.07.21 |

| 요즘 매도하거나 피해야 할 주식 Top5_미국주식x미국개미 (2) | 2021.07.21 |