선요약 : 골드만삭스는 연말에 가장 강력한 매출 성장을 제공할 준비가 되어 있는 21개의 주식을 매수하겠다고 하는데,,, 과연?

골드만삭스의 수석 주식전략가인 데이비드 코스틴은 코로나바이러스 대유행 이전에도 투자전략으로 매출 성장성이 높은 주식을 소개했었다.

코스틴의 포트폴리오 전략 연구팀은 S&P 500 지수를 심사해 연말까지 예상 매출 성장률을 기준으로 순위에 오른 100대 종목을 파악했다.

그 중 비즈니스인사이더가 매출 성장률이 15%를 넘을 것으로 예상되는 21개 회사로 추렸는데, 아래와 같다.

21개 종목은 연말까지 예상 매출 성장률을 기준으로 최하위에서 최고로 순위가 내려간다.

21. Humana 휴마나

Ticker: HUM

Sector: Healthcare

Market cap: $54.01 billion

Year-to-date performance: 13.42%

Expected sales growth: 16%

Source: Goldman Sachs

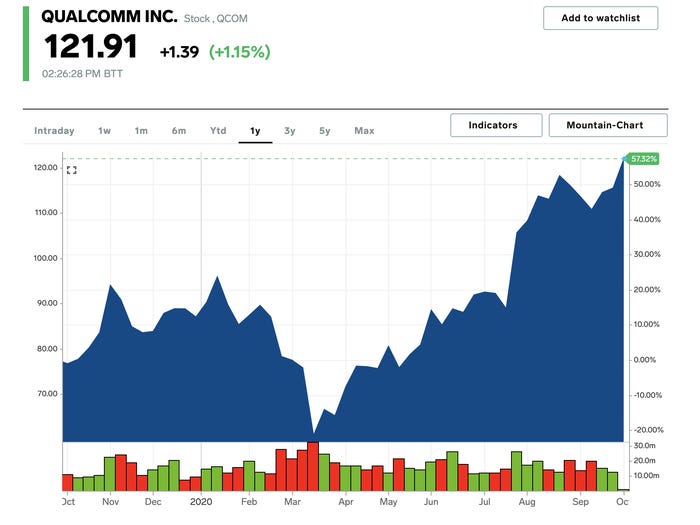

20. Qualcomm 퀄컴

Ticker: QCOM

Sector: Technology

Market cap: $130.27 billion

Year-to-date performance: 35.38%

Expected sales growth: 16%

Source: Goldman Sachs

19. Adobe 어도비

Ticker: ADBE

Sector: Technology

Market cap: $229.76 billion

Year-to-date performance: 45.45%

Expected sales growth: 16%

Source: Goldman Sachs

18. Lowe's Cos. 로우스

Ticker: LOW

Sector: Consumer cyclical

Market cap: $125.81 billion

Year-to-date performance: 37.65%

Expected sales growth: 16%

Source: Goldman Sachs

17. Dollar General 달러제네랄

Ticker: DG

Sector: Consumer defensive

Market cap: $52.67 billion

Year-to-date performance: 34.92%

Expected sales growth: 18%

Source: Goldman Sachs

16. Newmont 뉴몬트

Ticker: NEM

Sector: Basic materials

Market cap: $50.02 billion

Year-to-date performance: 39.02%

Expected sales growth: 19%

Source: Goldman Sachs

15. Salesforce 세일즈포스

Ticker: CRM

Sector: Technology

Market cap: $225.52 billion

Year-to-date performance: 53.99%

Expected sales growth: 20%

Source: Goldman Sachs

14. PayPal Holdings 페이팔

Ticker: PYPL

Sector: Financial services

Market cap: $225.15 billion

Year-to-date performance: 77.51%

Expected sales growth: 20%

Source: Goldman Sachs

13. Fidelity National Information Services 피델리티네셔널인포메이션서비스

Ticker: FIS

Sector: Technology

Market cap: $89.93 billion

Year-to-date performance: 4.16%

Expected sales growth: 22%

Source: Goldman Sachs

12. Netflix 넷플릭스

Ticker: NFLX

Sector: Communication services

Market cap: $221.84 billion

Year-to-date performance: 56.47%

Expected sales growth: 23%

Source: Goldman Sachs

11. Activision Blizzard 액티비전블리자드

Ticker: ATVI

Sector: Communication services

Market cap: $60.43 billion

Year-to-date performance: 32.98%

Expected sales growth: 23%

Source: Goldman Sachs

10. ServiceNow 서비스나우

Ticker: NOW

Sector: Technology

Market cap: $94.58 billion

Year-to-date performance: 73.81%

Expected sales growth: 28%

Source: Goldman Sachs

9. Global Payments 글로벌페이먼츠

Ticker: GPN

Sector: Industrials

Market cap: $53.39 billion

Year-to-date performance: -3.55%

Expected sales growth: 29%

Source: Goldman Sachs

8. Amazon 아마존

Ticker: AMZN

Sector: Consumer cyclical

Market cap: $1.565 trillion

Year-to-date performance: 67.85%

Expected sales growth: 31%

Source: Goldman Sachs

7. Advanced Micro Devices

Ticker: AMD

Sector: Technology

Market cap: $96.03 billion

Year-to-date performance: 85.59%

Expected sales growth: 33%

Source: Goldman Sachs

6. Fiserv 파이서브

Ticker: FISV

Sector: Technology

Market cap: $68.06 billion

Year-to-date performance: -11.35%

Expected sales growth: 36%

Source: Goldman Sachs

5. AbbVie 에브비

Ticker: ABBV

Sector: Healthcare

Market cap: $151.97 billion

Year-to-date performance: -2.97%

Expected sales growth: 37%

Source: Goldman Sachs

4. Nvidia 엔비디아

Ticker: NVDA

Sector: Technology

Market cap: $322.72 billion

Year-to-date performance: 136.51%

Expected sales growth: 41%

Source: Goldman Sachs

3. T-Mobile 티모바일

Ticker: TMUS

Sector: Communication services

Market cap: $140.37 billion

Year-to-date performance: 44.29%

Expected sales growth: 47%

Source: Goldman Sachs

2. Vertex Pharmaceuticals 버텍스파마세큐티컬

Ticker: VRTX

Sector: Healthcare

Market cap: $67.92 billion

Year-to-date performance: 19.19%

Expected sales growth: 49%

Source: Goldman Sachs

1. Bristol-Myers Squibb 브리스톨마이어스스큅

Ticker: BMY

Sector: Healthcare

Market cap: $132.34 billion

Year-to-date performance: -9.4%

Expected sales growth: 61%

Source: Goldman Sachs

Get the latest Goldman Sachs stoc

#출처 : Business insider

# 본 글은 주식 매수 매도 추천글이 아닙니다. 본 글에서 거론된 주식의 매수,매도는 투자자 본인의 판단이며 그 결과 또한 투자자 본인의 책임입니다.

'미국주식' 카테고리의 다른 글

| AT&T(T) 배당컷 가능할까?_미국주식x미국개미 (2) | 2020.10.09 |

|---|---|

| 매드머니 짐크래머:반독점 규제엔 기술주매수!_미국주식x미국개미 (2) | 2020.10.08 |

| 골드만삭스 추천주식_미국주식x미국개미 (0) | 2020.10.08 |

| 인터넷 온라인 상에서 1분동안 벌어지는 일들_미국주식x미국개미 (0) | 2020.10.07 |

| 유망성장주:스톤코(STNE), 임핀지(PI), 클라우드플레어(NET)_미국주식x미국개미 (0) | 2020.10.07 |