모닝스타에서 선정한 저평가 32개 종목입니다.

바쁜 사람들을 위해서 선 요약

# 32개중에 경제적 해자가 좋고, 시가총액 높은종목들

=> 인텔, 록히드마틴, 3M, 화이자, 짐머, CVS헬스, 버크셔헤서웨이, 아메리칸익스프레스, 엔브릿지, 엔하이저부쉬, 디즈니, 컴캐스트, 구글,

MATERIALS STOCK No. 1: Corteva (CTVA)

Stock: Corteva

Sector: Materials

Market cap: $20 billion

Economic moat: Wide

Source: Morningstar, Markets Insider

MATERIALS STOCK No. 2: Ecolab (ECL)

Stock: Ecolab

Sector: Materials

Market cap: $52 billion

Economic moat: Wide

Source: Morningstar, Markets Insider

MATERIALS STOCK No. 3: Vulcan Materials (VMC)

Stock: Vulcan Materials

Sector: Materials

Market cap: $16 billion

Economic moat: Narrow

Source: Morningstar, Markets Insider

COMMUNICATION-SERVICES STOCK No. 1: Alphabet (GOOGL)

Stock: Alphabet

Sector: Communication services

Market cap: $777 billion

Economic moat: Wide

Source: Morningstar, Markets Insider

COMMUNICATION-SERVICES STOCK No. 2: Comcast (CMCSA)

Stock: Comcast

Sector: Communication services

Market cap: $171 billion

Economic moat: Wide

Source: Morningstar, Markets Insider

COMMUNICATION-SERVICES STOCK No. 3: Disney (DIS)

Stock: Disney

Sector: Communication services

Market cap: $192 billion

Economic moat: Wide

Source: Morningstar, Markets Insider

CONSUMER-DISCRETIONARY STOCK No. 1: Carnival (CCL)

Stock: Carnival

Sector: Consumer discretionary

Market cap: $8 billion

Economic moat: Narrow

Source: Morningstar, Markets Insider

CONSUMER-DISCRETIONARY STOCK No. 2: Hanesbrands (HBI)

Stock: Hanesbrands

Sector: Consumer discretionary

Market cap: $3 billion

Economic moat: Narrow

Source: Morningstar, Markets Insider

CONSUMER-STAPLES STOCK No. 1: Anheuser-Busch InBev (BUD)

Stock: Anheuser-Busch InBev

Sector: Consumer staples

Market cap: $82 billion

Economic moat: Wide

Source: Morningstar, Markets Insider

CONSUMER-STAPLES STOCK No. 2: Constellation Brands (STZ)

Stock: Constellation Brands

Sector: Consumer staples

Market cap: $30 billion

Economic moat: Wide

Source: Morningstar, Markets Insider

CONSUMER-STAPLES STOCK No. 3: US Foods Holding (USFD)

Stock: US Foods Holding

Sector: Consumer staples

Market cap: $4 billion

Economic moat: None

Source: Morningstar, Markets Insider

ENERGY STOCK No. 1: Enbridge (ENB)

Stock: Enbridge

Sector: Energy

Market cap: $62 billion

Economic moat: Wide

Source: Morningstar, Markets Insider

ENERGY STOCK No. 2: Enterprise Products Partners (EPD)

Stock: Enterprise Products Partners

Sector: Energy

Market cap: $39 billion

Economic moat: Wide

Source: Morningstar, Markets Insider

ENERGY STOCK No. 3: Schlumberger (SLB)

Stock: Schlumberger

Sector: Energy

Market cap: $24 billion

Economic moat: Narrow

Source: Morningstar, Markets Insider

FINANCIAL STOCK No. 1: American Express (AXP)

Stock: American Express

Sector: Financials

Market cap: $77 billion

Economic moat: Wide

Source: Morningstar, Markets Insider

FINANCIAL STOCK No. 2: Berkshire Hathaway (BRK.B)

Stock: Berkshire Hathaway

Sector: Financials

Market cap: $474 billion

Economic moat: Wide

Source: Morningstar, Markets Insider

FINANCIAL STOCK No. 3: Broadridge Financial Solutions (BR)

Stock: Broadridge Financial Solutions

Sector: Financials

Market cap: $12 billion

Economic moat: Narrow

Source: Morningstar, Markets Insider

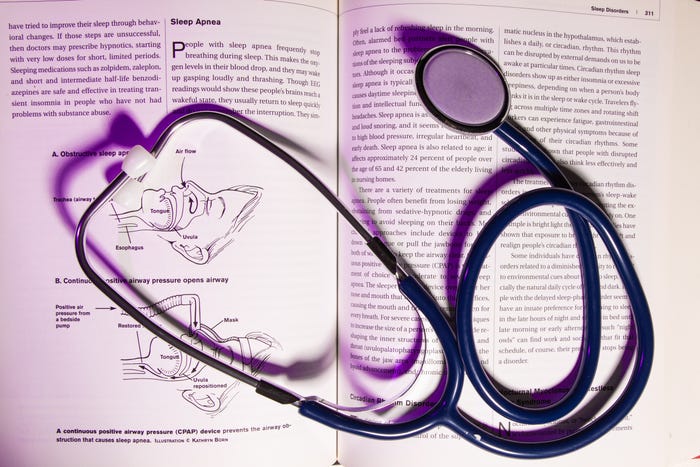

HEALTHCARE STOCK No. 1: CVS Health (CVS)

Stock: CVS Health

Sector: Healthcare

Market cap: $78 billion

Economic moat: Narrow

Source: Morningstar, Markets Insider

HEALTHCARE STOCK No. 2: Pfizer (PFE)

Stock: Pfizer

Sector: Healthcare

Market cap: $198 billion

Economic moat: Wide

Source: Morningstar, Markets Insider

HEALTHCARE STOCK No. 3: Zimmer Biomet Holdings (ZBH)

Stock: Zimmer Biomet Holdings

Sector: Healthcare

Market cap: $23 billion

Economic moat: Wide

Source: Morningstar, Markets Insider

INDUSTRIAL STOCK No. 1: 3M (MMM)

Stock: 3M

Sector: Industrials

Market cap: $85 billion

Economic moat: Wide

Source: Morningstar, Markets Insider

INDUSTRIAL STOCK No. 2: Deere (DE)

Stock: Deere

Sector: Industrials

Market cap: $47 billion

Economic moat: Wide

Source: Morningstar, Markets Insider

INDUSTRIAL STOCK No. 3: Lockheed Martin (LMT)

Stock: Lockheed Martin

Sector: Industrials

Market cap: $105 billion

Economic moat: Wide

Source: Morningstar, Markets Insider

REAL-ESTATE STOCK No. 1: Pebblebrook Hotel Trust (PEB)

Stock: Pebblebrook Hotel Trust

Sector: Real estate

Market cap: $2 billion

Economic moat: None

Source: Morningstar, Markets Insider

REAL-ESTATE STOCK No. 2: Simon Property Group (SPG)

Stock: Simon Property Group

Sector: Real estate

Market cap: $22 billion

Economic moat: Narrow

Source: Morningstar, Markets Insider

REAL-ESTATE STOCK No. 3: Ventas (VTR)

Stock: Ventas

Sector: Real estate

Market cap: $13 billion

Economic moat: None

Source: Morningstar, Markets Insider

TECHNOLOGY STOCK No. 1: Intel (INTC)

Stock: Intel

Sector: Technology

Market cap: $250 billion

Economic moat: Wide

Source: Morningstar, Markets Insider

TECHNOLOGY STOCK No. 2: Palo Alto Networks (PANW)

Stock: Palo Alto Networks

Sector: Technology

Market cap: $18 billion

Economic moat: Narrow

Source: Morningstar, Markets Insider

TECHNOLOGY STOCK No. 3: VMWare (VMW)

Stock: VMWare

Sector: Technology

Market cap: $14 billion

Economic moat: Narrow

Source: Morningstar, Markets Insider

UTILITY STOCK No. 1: AES Corp. (AES)

Stock: AES Corp.

Sector: Utilities

Market cap: $10 billion

Economic moat: None

Source: Morningstar, Markets Insider

UTILITY STOCK No. 2: Duke Energy (DUK)

Stock: Duke Energy

Sector: Utilities

Market cap: $64 billion

Economic moat: Narrow

Source: Morningstar, Markets Insider

UTILITY STOCK No. 3: Edison International (EIX)

Stock: Edison International

Sector: Utilities

Market cap: $22 billion

Economic moat: Narrow

Source: Morningstar, Markets Insider

# 본 글은 주식 매수 매도 추천글이 아닙니다. 본 글에서 거론된 주식의 매수,매도는 투자자 본인의 판단이며 그 결과 또한 투자자 본인의 책임입니다.

'미국주식' 카테고리의 다른 글

| 미국 화상회의 앱 사용 급증 _ 미국주식 X 미국개미 (3) | 2020.04.16 |

|---|---|

| 새로운 2020 아이폰SE 399$ 발표(55만원) _ 미국주식 X 미국개미 (0) | 2020.04.16 |

| COVID-19퇴치에 기여하는 미국테크기업 _ 미국주식 X 미국개미 (0) | 2020.04.14 |

| 미국인들이 지금 사재기 하는 물품은?_ 미국주식 X 미국개미 (5) | 2020.04.13 |

| 골드만삭스의 코로나-19 이겨낼 유망기업 12개_ 미국주식 X 미국개미 (2) | 2020.04.13 |